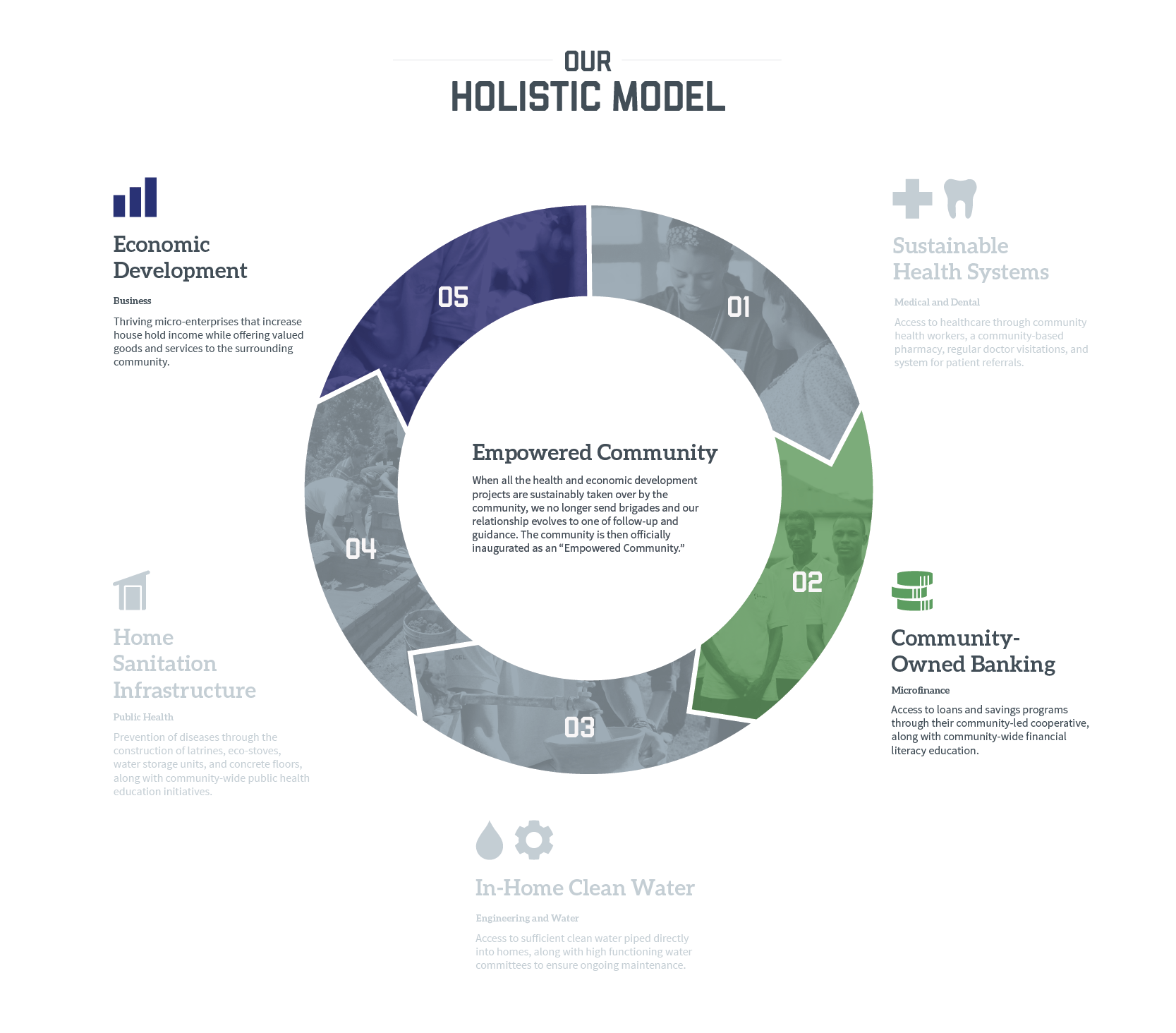

A Holistic View

Global Brigades uniquely implements a holistic model to meet a community’s health and economic goals. Our model systematically builds community ownership and collaboratively executes programs with the end goal of sustainably evolving to a relationship of monitoring and guidance.

Empowered Communities | All Programs Implemented

| # | Community Name | Country | Population |

|---|---|---|---|

| 1 | El Zurzular | Honduras | 600 |

| 2 | El Canton | Honduras | 500 |

| 3 | El Ojochal | Honduras | 250 |

| 4 | Palo Verde | Honduras | 250 |

| 5 | Guaricayán | Honduras | 185 |

| 6 | El Jute | Honduras | 380 |

| 7 | El Junco y Joyas | Honduras | 200 |

| 8 | El Encinal | Honduras | 185 |

| 9 | Fray Lazaro | Honduras | 550 |

| 10 | Tomatin | Honduras | 250 |

| 11 | Piriati Embera | Panama | 780 |

| 12 | La Concepción | Honduras | 570 |

| 13 | El Espinito | Honduras | 450 |

Building Rural Economies

Our Business program is the backbone of our holistic model and is implemented with four core components: creating and strengthening community-owned banks, increasing family income, fostering a culture of savings, and ensuring access to capital for low-interest loans.

Community-Owned Banks

Local leaders are identified and trained by our staff and volunteers to organize Community-Owned Banks to provide critical financial services to the community. Local governments recognize these banks as legitimate institutions allowing them to provide access to savings and loans. We have organized more than 50 community-owned banks, providing thousands of otherwise isolated families with access to these services.

Savings Mobilization

Through regular trainings, our staff and volunteers work to creating a culture of savings in the community alongside the creation of the banks. Saving demonstrates the value of longer term horizons, goal setting, provides for a safety net, and capitalizes local banks with funds available for entrepreneurs to take loans or create micro-enterprises.

Income Growth

Our staff identify business opportunities and facilitate consulting projects between the volunteers and entrepreneurs to help small businesses grow. Staff and volunteers help entrepreneurs determine the financial return on potential investments and whether loans are a prudent tool for growth.

Access to Capital

Volunteers and donors contribute the essential funds for community-owned banks to lend to local businesses for their investments. The funds are repaid and recirculated back into the local economy, exponentially growing the accounts. Commonly, our banks start with just a few hundred dollars, but will grow grow within 2-3 years of having more than $10,000 USD. For communities averaging about 100 homes and making less than $2 it can be life-changing.

Success Indicator | Empowered 100 Goal #5

Equal access to sufficient, affordable credit with a trained Community Bank in place.

Current status: 62 of 100 Communities

2019 progress

- 61 Community Banks established and trained

2018 progress

- 59 Community Banks established and trained

2017 progress

- 14 Community Banks established and trained