MICROFINANCE WAS MISSING EQUITY

Eskala creates and invests in locally owned banking cooperatives in emerging economies. We plan to manage a portfolio of 20,000 banking, agroforestry, and agricultural cooperatives that will empower 18 million people living in poverty with financial services

Building Rural Economies

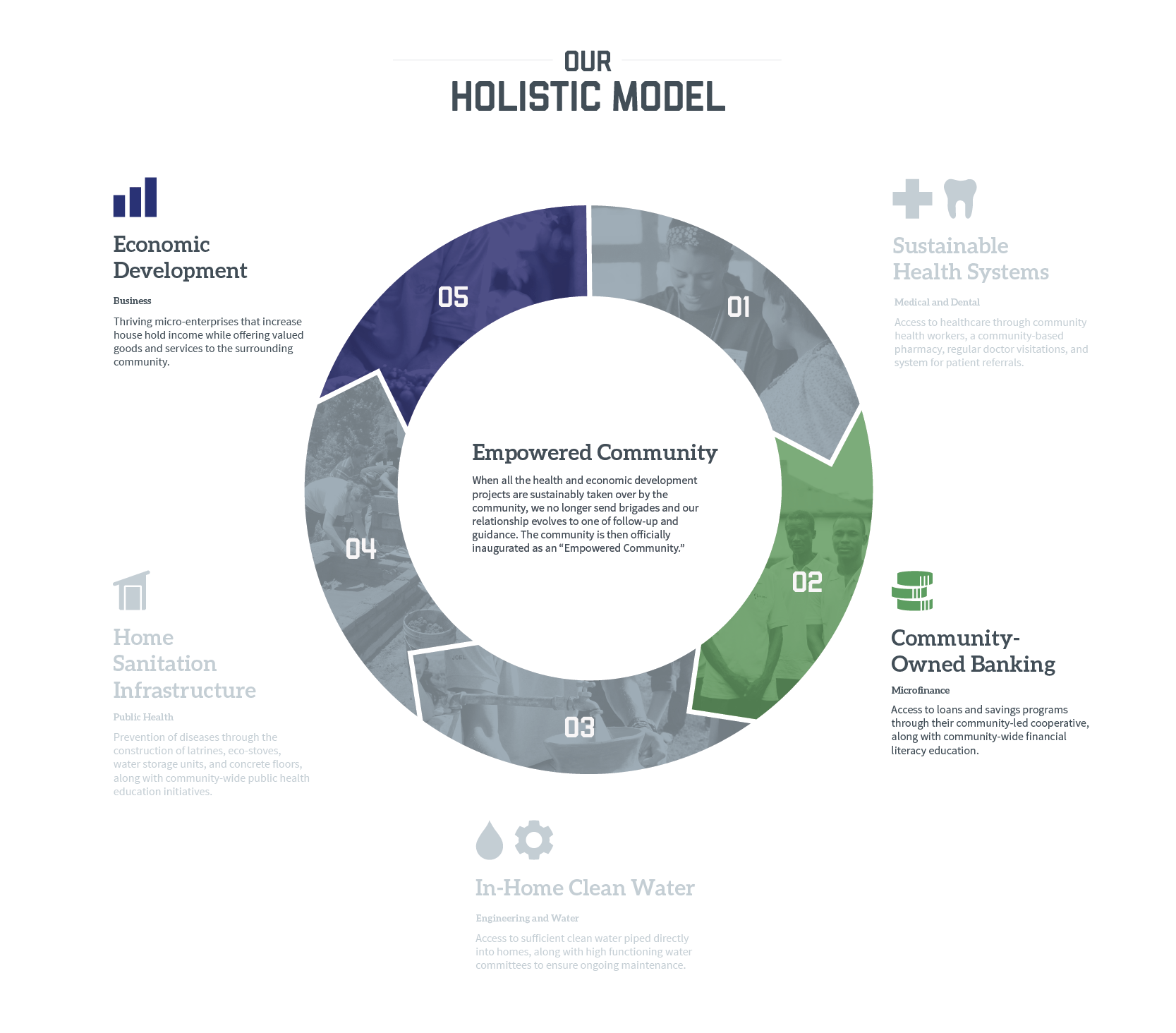

ESKALA works alongside with Global Brigades, following the holistic model and implementing the four core components of it: creating and strengthening community-owned banks, increasing family income, fostering a culture of savings, and ensuring access to capital for low-interest loans.

Community-Owned Banks

Local leaders are identified and trained by our staff and volunteers from Global Brigades to organize Community-Owned Banks to provide critical financial services to the community. Local governments recognize these banks as legitimate institutions allowing them to provide access to savings and loans. During this time, we have organized more than 50 community-owned banks, providing thousands of otherwise isolated families with access to these services.

Savings Mobilization

Through regular training, our staff and volunteers work to create a culture of savings in the community alongside the creation of the banks. Saving demonstrates the value of longer-term horizons, and goal setting, provides a safety net, and capitalizes local banks with funds available for entrepreneurs to take loans or create micro-enterprises.

Income Growth

Our staff identifies business opportunities and facilitates consulting projects between the volunteers and entrepreneurs to help small businesses grow. Staff and volunteers help entrepreneurs determine the financial return on potential investments and whether loans are a prudent tool for growth.

Access to Capital

Thanks to the support of our investors and Volunteers, they contribute the essential funds for community-owned banks to lend to local businesses for their investments. The funds are repaid and recirculated back into the local economy, exponentially growing the accounts. Commonly, our banks start with just a few hundred dollars but will grow within 2-3 years of having more than USD 10,000. For communities averaging about 100 homes and making less than $2, these can be a life-changing opportunity.

Why We Are Different

Unlike other microfinance institutions, Eskala doesn’t just lend, it invests to acquire equity positions in banking cooperatives that manage a hyperlocal savings and loan portfolio. The current asset base of 93 banks located in rural and under resourced Central America has generated more than $250k in profit for local communities and was named the best economic development initiative in rural Panama by the World Bank.

Want to be part? Contact us

ESKALA International Consulting Programs

ESKALA partners with Global Brigades to provide student-led consulting services in the communities it works. Our programs are designed to provide participants with hands-on experience in consulting, as well as the opportunity to make a real impact on the communities we serve.

ESKALA is currently offering an in-person brigade in Panama. This brigade will provide participants with the opportunity to work with small businesses and organizations in different communities. Participants will work on a variety of projects, such as developing marketing plans, improving financial management, and creating new products.

To learn more about ESKALA’s international consulting programs, please visit our Consulting Abroad page.